In today’s age of electronic commerce, when I leave my place, I will only bring my cell phone, key, debit / credit card and opal card with me. How about money? Nahhh… Debit cards/ credit cards are much more convenient as I don’t have to worry whether I have enough to pay or to get loads of heavy small change. However, it reminds me of one of our readers’ cases – Miss L’s credit card fraud. Here comes the question, what’s the difference between debit card and credit card? And is a debit card or credit card safer?

What’s difference between debit card and credit card?

Debit card and credit card may look visually similar to you, but there are significant differences between them.

Generally credit card is not linked to your current account. Therefore, when you buy things today, you will pay for them later. At the end of each month, you will receive your outstanding balance. You can choose either paying the bill in full at a certain day and incur no interest or paying the minimum payment and spread the rest of the repayments out over time and being charged for interest. Credit card is commonly used as users can also join the rewards programs, interest-free days, and the ability to use the banks’ money.

A debit card is whereas linked to your current account. When you purchase thing, money you spend will be automatically taken from your current account. Debit cards are attractive to those who like to stick to budget on their own money.

Is debit card or credit card safer?

Indeed, card users are not liable for unauthorized purchase for both credit and debit cards and all major credit and debit card issuers offer $0 liability guarantees for an unauthorized charge. However, as credit card users don’t have to pay the bill immediately right after they receive the statement (at least 21 days from the time a statement is available to pay the amount due), customers will have much more time to notice unauthorized charges, notify your issuer of the problem and have them removed from your bill. For debit cards, when the identity thieves use your card to purchase things, it will pay immediately from your account and may clear out your bank account before you notice. Therefore, it will take much longer time for you to recover all of your money after you contact your bank.

How to protect yourself?

Here’re a few things you can do no matter you are using debit/credit cards:

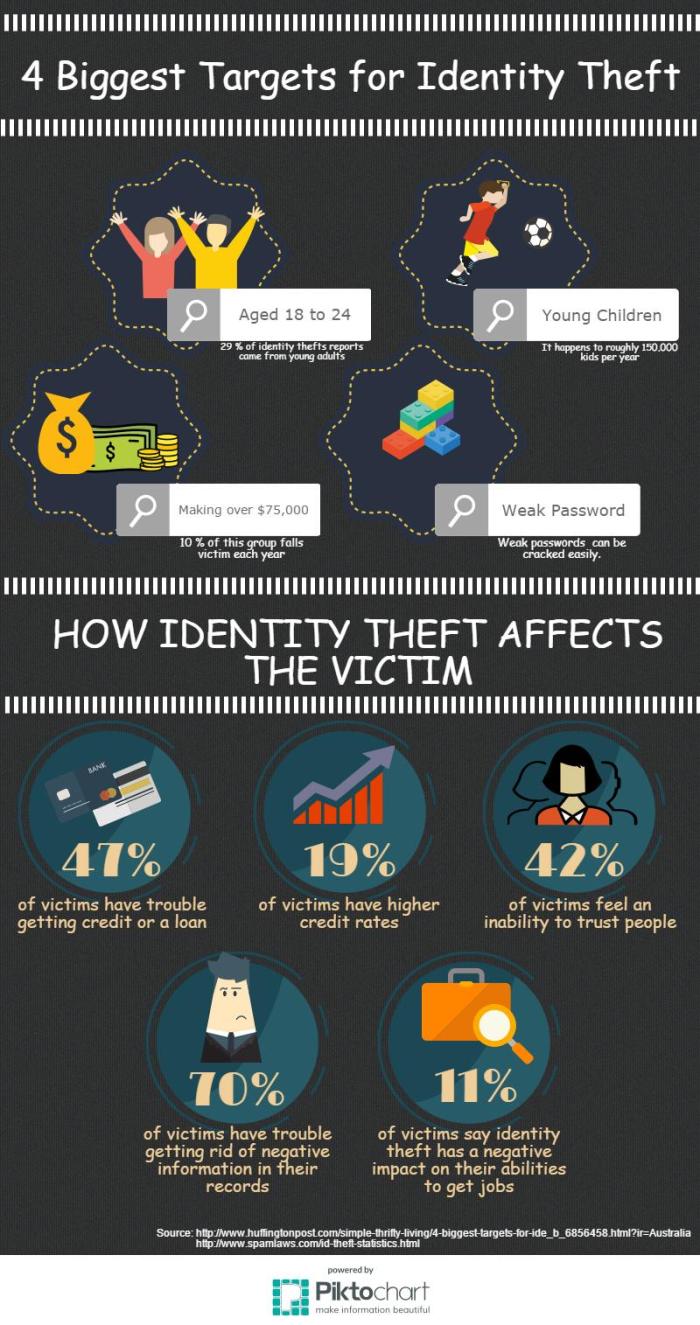

- Change your passwords and use a secure password for your bank account

- Check your credit reports regularly

- Shred financial documents as identity thieves may look through your garbage bins

- Verify web security. Only provide personal financial information on “https” websites

- Keep your Tax File Number (TFN) private. You should only give your TFN to reputable companies after you have contacted them

- Clear your mailbox regularly as mail overflowing is an opportunity for identity theft.

-KYCL-